Introduction

The home buying journey can be complex, particularly for veterans, active-duty service members, and eligible surviving spouses exploring VA loans. Among the critical questions that arise is, “What is the minimum credit score required to secure a VA loan?” This becomes even more nuanced when dealing with private lenders such as Rocket Mortgage—one of the largest and most recognized mortgage lenders in the United States. Understanding how Rocket Mortgage evaluates VA loan applications, particularly in terms of credit score, can make all the difference in a borrower’s path to homeownership.

This article provides a comprehensive analysis of the minimum credit score required for a VA loan through Rocket Mortgage. We will explore how VA loans work, how credit scores impact loan approval, what Rocket Mortgage specifically looks for, and how you can improve your chances of qualifying—even if your credit is less than perfect. We will also discuss other VA loan eligibility criteria, alternative financing options, and tips for navigating the process smoothly.

Understanding VA Loans

What is a VA Loan?

A VA loan is a mortgage loan program backed by the U.S. Department of Veterans Affairs. It is designed to help veterans, service members, and certain military-affiliated individuals purchase, build, or refinance homes. VA loans offer several benefits that make homeownership more accessible, including:

-

No down payment required (in most cases)

-

Competitive interest rates

-

No private mortgage insurance (PMI)

-

Limited closing costs

-

Flexible credit guidelines

However, VA loans are not provided directly by the VA. Instead, they are issued by private lenders such as Rocket Mortgage, with the VA guaranteeing a portion of the loan to reduce the lender’s risk.

Eligibility for a VA Loan

To qualify for a VA loan, you must meet one or more of the following criteria:

-

Served 90 consecutive days of active service during wartime

-

Served 181 days of active service during peacetime

-

Have more than six years of service in the National Guard or Reserves

-

Are the spouse of a service member who died in the line of duty or from a service-connected disability

Once eligibility is established, lenders such as Rocket Mortgage evaluate your creditworthiness and financial profile to determine loan approval.

The Role of Credit Scores in Mortgage Lending

What is a Credit Score?

A credit score is a three-digit number that represents a borrower’s creditworthiness based on their financial history. Commonly measured using FICO or VantageScore models, credit scores range from 300 to 850. Higher scores indicate stronger credit profiles and a lower risk for lenders.

Factors affecting your credit score include:

-

Payment history (35%)

-

Credit utilization ratio (30%)

-

Length of credit history (15%)

-

Credit mix (10%)

-

New credit inquiries (10%)

Why Credit Scores Matter for VA Loans

Although the VA itself does not impose a minimum credit score, lenders who issue VA loans often set their own requirements. Credit scores help lenders determine your ability to repay the loan and the interest rate you may receive. Even with VA backing, private lenders still assess risk when approving borrowers.

Rocket Mortgage and VA Loans

Who Is Rocket Mortgage?

Rocket Mortgage, a subsidiary of Rocket Companies, is a leading online mortgage lender known for streamlining the loan process through digital innovation. It offers a range of loan products, including conventional, FHA, jumbo, and VA loans. Rocket Mortgage has earned a reputation for fast processing, excellent customer service, and a user-friendly platform.

Rocket Mortgage’s Approach to VA Loans

Rocket Mortgage is an approved VA lender and offers VA purchase and refinance loans to eligible applicants. While adhering to VA guidelines, Rocket Mortgage also applies its own underwriting standards—especially when it comes to credit scores and financial qualifications.

Rocket Mortgage Minimum Credit Score for VA Loans

The Minimum Credit Score Requirement

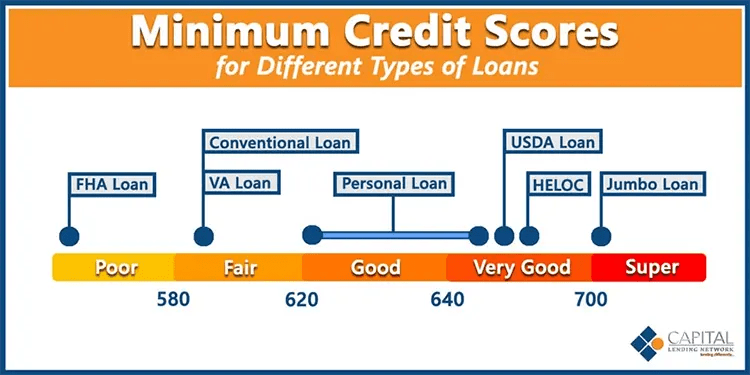

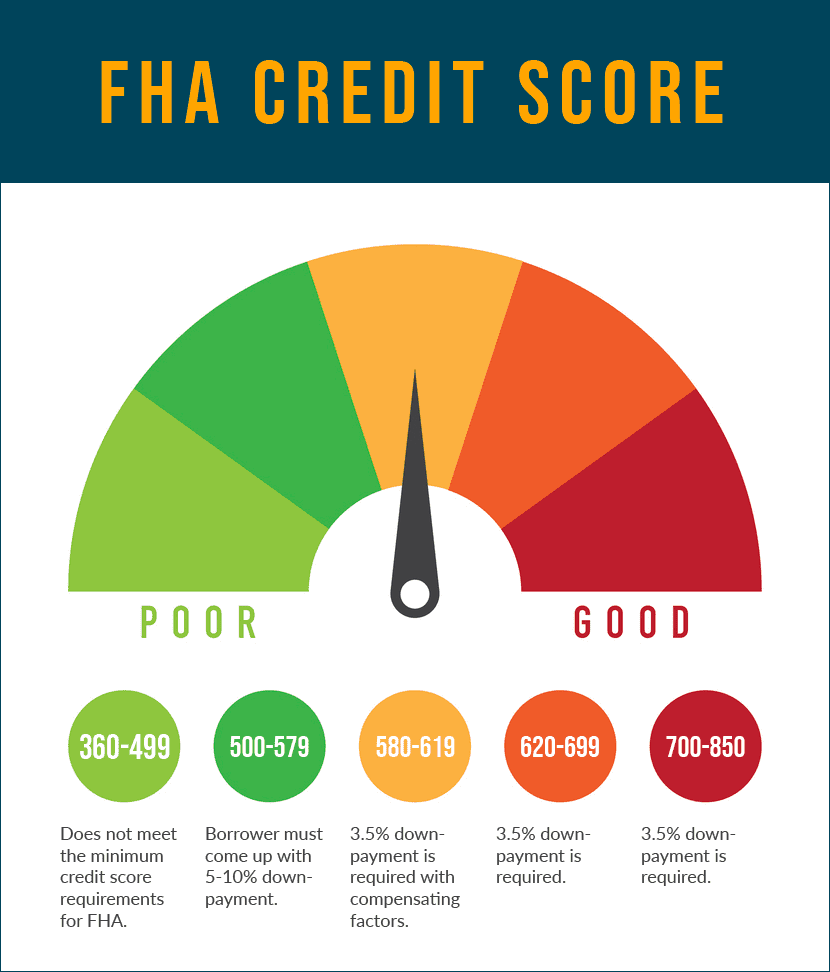

Rocket Mortgage typically requires a minimum credit score of 580 for VA loans. This benchmark is slightly more lenient than conventional loans, which often require scores of 620 or higher.

However, while 580 is the minimum, approval is not guaranteed solely based on hitting this number. Rocket Mortgage evaluates multiple aspects of a borrower’s profile, including:

-

Debt-to-income ratio (DTI)

-

Income stability

-

Employment history

-

Assets and reserves

-

Loan-to-value ratio (LTV)

In practice, borrowers with higher credit scores are more likely to receive favorable terms and faster approval.

Why 580?

The 580 threshold reflects a balance between inclusivity and risk management. It allows more borrowers to qualify while maintaining a baseline level of financial reliability. Rocket Mortgage uses automated underwriting systems that assess credit and financial data holistically, so exceptions may occur in some cases, particularly if other factors are strong.

Factors Influencing VA Loan Approval at Rocket Mortgage

Debt-to-Income Ratio (DTI)

Even if your credit score meets the minimum, your DTI ratio plays a significant role in approval. DTI is the percentage of your gross monthly income used to pay monthly debts. Rocket Mortgage typically prefers a DTI below 45%, though some flexibility may be allowed.

Residual Income

VA loans also require a residual income analysis, ensuring that borrowers have enough money left after all expenses. Rocket Mortgage adheres to this guideline closely to ensure sustainable homeownership.

Employment and Income Verification

Stable employment and consistent income over the past two years are critical. Rocket Mortgage will verify job history and income through W-2s, pay stubs, or tax returns.

Credit History

While the score is essential, Rocket Mortgage also evaluates your broader credit history. Late payments, bankruptcies, or foreclosures may impact your application, especially if recent.

How to Improve Your Chances of Approval

Raise Your Credit Score

If your credit score is near or below 580, consider taking steps to raise it before applying:

-

Pay all bills on time

-

Reduce credit card balances

-

Avoid new credit inquiries

-

Dispute errors on your credit report

Reduce Your Debt

Lowering your DTI can significantly improve your approval odds. Pay down loans or credit card balances where possible.

Save for Reserves

Even though VA loans don’t require a down payment, having cash reserves can make you a more attractive borrower. Rocket Mortgage may view savings as a buffer against unexpected financial stress.

Get Pre-Approved

Pre-approval from Rocket Mortgage gives you a clearer picture of what you can afford and strengthens your position when making offers. It also helps identify potential obstacles early in the process.

VA Loan Alternatives If You Don’t Qualify

If you do not meet the minimum credit score for a VA loan through Rocket Mortgage, you might consider alternative options:

Other VA Lenders

Some lenders may offer more flexible credit criteria. Shop around and compare.

FHA Loans

FHA loans are government-backed mortgages with credit score requirements as low as 500 (with a 10% down payment) or 580 (with 3.5% down).

Credit Repair and Counseling

Professional credit counselors can help you develop a personalized plan to improve your financial standing and eventually qualify for a VA loan.

Pros and Cons of Using Rocket Mortgage for VA Loans

Pros

-

Digital convenience: Apply and manage your loan entirely online.

-

Fast processing: Streamlined approval and closing process.

-

Transparency: Easy-to-understand tools and customer support.

-

Experience: A trusted lender with a strong reputation.

Cons

-

Credit score threshold: The 580 requirement may still be out of reach for some.

-

Limited flexibility: Compared to smaller lenders, Rocket Mortgage may be less flexible on certain edge cases.

-

Automated approach: Less room for human discretion in underwriting.

Frequently Asked Questions

Is the 580 Credit Score Requirement Set by the VA?

No. The Department of Veterans Affairs does not set a minimum credit score. Each lender, including Rocket Mortgage, determines its own standards.

Can I Get a VA Loan With a Lower Score?

Possibly, but not through Rocket Mortgage. You may need to find a more flexible lender or take time to improve your score.

Does Rocket Mortgage Charge VA Loan Fees?

VA loans come with a funding fee set by the VA, not the lender. Rocket Mortgage may charge standard closing costs, but these are often comparable to or lower than traditional loans.

How Long Does the Approval Process Take?

Rocket Mortgage typically processes VA loans within 30 to 45 days, though timelines can vary based on your financial situation and responsiveness.

Final Thoughts

Rocket Mortgage offers a compelling option for veterans and service members seeking a VA loan—particularly those who value digital convenience and fast processing. With a minimum credit score requirement of 580, Rocket Mortgage provides access to many borrowers while maintaining responsible lending practices.

However, it’s important to remember that your credit score is just one part of the overall application. Factors like debt-to-income ratio, residual income, employment stability, and credit history all contribute to the final decision.

If you meet or exceed the credit requirement, Rocket Mortgage can be an efficient and trustworthy partner in your home buying journey. If you’re not quite there yet, don’t be discouraged—there are many ways to build your credit and become a strong candidate in the near future.

By understanding what Rocket Mortgage looks for in VA loan applicants, and taking proactive steps to improve your financial health, you can move closer to the goal of homeownership with confidence and clarity.